Introduction

Revoking a revocable trust can be a challenging but manageable process if you understand the necessary steps. Whether you’re looking to revoke all terms and conditions or alter the terms of the trust, it is important to follow the legal procedures outlined in the trust agreement. This ensures that the trust revocation declaration is properly executed. Trustees must also notify the relevant parties and transfer all assets from the trust back into the grantor’s name. It is essential to consult with a trust attorney to ensure that the trust revocation forms are drafted and filed correctly.

In some cases, people might choose to revoke their trust due to life changes such as marriage or divorce, or they may want to dissolve a trust that no longer serves its purpose. The authority to revoke a trust is typically provided within the trust document, allowing the grantor the flexibility to terminate the trust or modify it at any time.

Key Takeaways

- Revoking a revocable trust involves following the necessary legal procedures to ensure all assets are transferred back and the trust is properly dissolved.

- The trust revocation declaration must be signed and notarized to be legally binding, with a trust attorney often guiding the process.

- Significant life events, such as marriage or financial changes, can prompt someone to revoke their trust and dissolve its terms.

- The differences between revoking a revocable vs. irrevocable trust are crucial, as the latter requires specific legal conditions or court approval.

- Consulting a trust attorney helps avoid legal complications with beneficiaries and ensures compliance with state-specific trust laws.

- Proper management of assets in the trust post-revocation is essential to protect against legal or financial issues.

How to Revoke a Revocable Trust Efficiently

Revoking a revocable trust can be a complex process but understanding the steps will help ensure everything goes smoothly. Whether you want to revoke your trust due to changes in life circumstances or to create a new one, following the trust’s legal provisions is crucial. Trustees need to be aware of the right to revoke at any time, as stated in the trust document. Consulting with a trust attorney can provide the necessary guidance to dissolve a revocable trust while ensuring the assets in the trust are properly managed.

Key Steps for Revoking a Revocable Trust

Remove All Assets from the Trust

The first step in revoking a revocable trust is transferring all assets, such as property or financial accounts, back into the grantor’s name. This ensures that no property remains under the trust’s control.Draft a Trust Revocation Declaration

A formal revocation document, often called a trust revocation declaration, must be created. This legal document should clearly state the intent to revoke all terms and conditions of the trust and must be signed and notarized.Notify the Trustee and Beneficiaries

It’s essential to notify any trustees and beneficiaries about the revocation. This communication ensures transparency and helps prevent future legal disputes.File with Relevant Authorities

In some cases, especially where the trust is registered, the revocation document must be filed with the appropriate court or authority. This formalizes the dissolution.

Steps to Revoke a Revocable Trust

The process to revoke a revocable trust involves a few key steps. First, review the trust document to understand its terms. The next step is to draft a revocation declaration, which clearly states your intent to dissolve the trust. This document must be signed and notarized. Afterward, you’ll need to remove any assets in the trust and transfer them back into your name. Consulting a trust attorney is often recommended to ensure the process complies with local trust law and avoids any legal complications. Lastly, notify any relevant parties, such as the trustee and beneficiaries, of the trust revocation.

When to Dissolve a Revocable Trust

Deciding when to dissolve a revocable trust can depend on several factors. You might want to revoke the trust if your financial situation has changed, you want to update your estate plan, or you no longer need the protections provided by the trust. If the trust was created for a specific purpose that has been fulfilled, you can dissolve it to regain control of the assets. It’s important to follow the provisions of the trust and consult with a trust attorney to ensure the revocation is properly executed.

The Legal Process of Revoking a Living Trust

A living trust can be revoked at any time by the grantor, but it’s important to follow the proper legal procedures. The revocation form must be completed and submitted according to the trust law governing the trust. Those who want to revoke their trust should ensure all assets in the trust are handled correctly. Working with a trust attorney is often recommended to avoid any legal pitfalls and to ensure the revocation is legally binding and meets the trust’s conditions.

Case Study: Revoking a Revocable Living Trust – The Case of Mr. Jackson

Mr. Jackson had established a revocable living trust to manage his assets and ensure a smooth transfer to his heirs. Years later, after a significant change in his financial situation, he decided it was time to revoke the trust and reorganize his estate. The first step was to ensure that all the assets previously transferred into the trust were reverted to his name. He consulted a trust attorney to help draft a trust revocation declaration, ensuring compliance with all legal requirements.

Once the revocation document was signed and notarized, Mr. Jackson submitted it to his trustee, officially dissolving the trust. The final step involved transferring all asset titles back to Mr. Jackson, preventing any confusion with future estate plans. By following the legal process and consulting professionals, Mr. Jackson successfully revoked his trust without legal complications.

Revocation Declaration: Legal Requirements

When revoking a living trust, it’s crucial to create a revocation declaration that complies with trust law. This document formally states your intention to dissolve the trust and must include specific language that references the trust by name. The revocation form must be signed and notarized to be legally valid. You should also include a detailed list of assets in the trust that are being transferred back to you. Consulting with a trust attorney is highly recommended, as mistakes in the revocation declaration can lead to legal disputes later on.

Handling Trust Assets After Revocation

Once you revoke a living trust, the next step is to transfer the trust’s assets back into your name. These assets may include property, bank accounts, or investments. If the assets are not properly removed from the trust, they may still be subject to the terms of the dissolved trust. A trust attorney can help ensure that the transfer of assets is handled correctly, protecting your legal rights and avoiding potential issues with creditors or tax authorities. Careful management of the assets post-revocation is essential.

Reasons for Revoking a Trust: Common Scenarios

There are several reasons why someone might want to revoke their trust. Life events such as divorce, new beneficiaries, or a change in financial circumstances often lead people to alter the trust or revoke it completely. Irrevocable trusts, however, require more specific legal conditions to dissolve, as trust law makes it harder to revoke an irrevocable trust. Trustees must understand the reason for revoking a trust and ensure they follow all legal guidelines to properly dissolve a revocable or irrevocable trust.

Life Events That Trigger Trust Revocation

Certain life events often lead people to revoke their trust. Divorce, remarriage, or the death of a beneficiary are common reasons for revoking a trust. Additionally, if there has been a significant change in your financial situation, such as receiving a large inheritance, you may want to alter the trust or revoke it entirely. Revocable trusts offer flexibility, allowing you to adapt your estate planning to reflect new circumstances. Consulting a trust attorney will ensure that your trust is legally modified or revoked in accordance with trust law.

Differences Between Revoking a Revocable vs. Irrevocable Trust

While revoking a revocable trust is relatively straightforward, dissolving an irrevocable trust is much more challenging. A revocable trust can be amended or revoked by the grantor at any time, but an irrevocable trust can only be dissolved under specific legal conditions. In some cases, trust law requires court approval to revoke an irrevocable trust. Understanding the distinctions between these types of trusts is important when considering trust revocation. Consulting a legal professional can help clarify which type of trust you have and how to proceed with revocation.

“Life is full of twists and turns. It’s possible that events like divorce, significant financial changes, remarriage, or shifting situations could impact an individual’s priorities when it comes to estate planning.” – Debra Bernier (DebraBernier)

How a Trust Attorney Can Assist with Trust Revocation

Trust revocation can be a complicated legal process that often requires the help of a qualified trust attorney. Whether you want to revoke a revocable living trust or dissolve a trust completely, an attorney can guide you through drafting the trust revocation forms and transferring assets from the trust. They can also ensure compliance with state-specific trust law and prevent any disputes with trust beneficiaries. Altering the trust or creating a new one requires professional oversight to ensure everything is legally binding.

The Role of a Trust Attorney in Revoking a Trust

A trust attorney plays a vital role in revoking a trust by providing legal guidance throughout the process. They will ensure that all legal documents, such as the revocation form and declaration, are correctly drafted and filed. Additionally, they can help navigate any legal challenges that arise, such as disputes with trust beneficiaries. Trust law varies by state, so working with an attorney ensures that the revocation complies with all relevant laws. Their expertise will help streamline the process and prevent potential legal pitfalls.

Avoiding Legal Complications with Trust Beneficiaries

When you revoke a trust, there is a chance that trust beneficiaries may contest the decision, especially if they stand to lose assets. A trust attorney can mediate disputes and ensure that your intentions are clearly outlined in the revocation documents. This can prevent beneficiaries from claiming assets that are no longer part of the trust. Ensuring that all parties are properly informed and that the revocation adheres to trust law will help avoid costly legal battles.

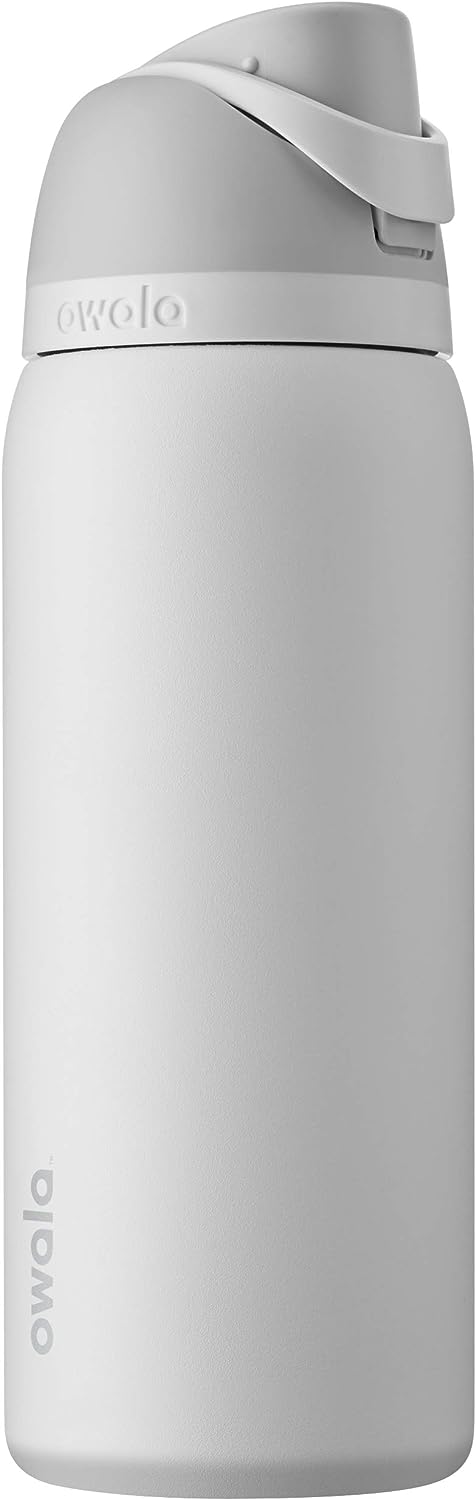

- BPA-Free Sports Water Bottle

- Great for Travel

- 32 Oz, Shy Marshmallow

Conclusion

Revoking a revocable trust may seem complicated, but it’s a flexible process if you understand the conditions of the trust. Following the legal procedures is key, especially when drafting the trust revocation declaration. Trustees need to ensure that all assets are properly transferred into the trust and then removed upon revocation. It’s important to consult with a trust attorney to ensure that the process is completed without errors, and all documents are filed correctly to avoid legal complications.

Sometimes, people might choose to revoke a trust due to life changes or financial shifts, which makes the right to revoke the trust crucial. By understanding the flexibility of a revocable trust and the ability to amend it at any time, trustees and grantors can make informed decisions about dissolving the trust. Whether the trust is irrevocable or not, knowing your options is essential to managing assets and maintaining the trust effectively.

James Dunnington leads the James Dunnington Collection, featuring five unique blogs: a practical Pet Care Guide, an enlightening Ancient History Blog, a resourceful Home Improvement Guide, a cutting-edge Tech Innovation Guide, and a strategic Online Money Making platform. Each site delivers valuable insights designed to empower and inform. For updates and more tips, visit our Contact Us page to sign up for our newsletter, ensuring you never miss out on the latest content from any of these dynamic fields.